Still at VoiceCon, there was a great presentation in a FMC panel by Vivek Khuller of DiVitas Networks. DiVitas has just released a product that rebuts the idea that cellular/Wi-Fi roaming requires participation by a Mobile Network Operator. Cellular companies get the vast bulk of their revenues from consumers, (though business users are more profitable) and have not been motivated to tailor their services to businesses. This offering from DiVitas, and MVNO efforts like Sotto address a gaping need in the market.

Vivek prefaced his presentation by enumerating three big-picture observations.

First, the current crop of FMC devices is actually the second generation – we just didn’t recognize the first generation, which is mobile computers. They are converged devices because they have multiple network connections: POTS (built-in modem), Ethernet, Wi-Fi and possibly a WWAN card from Verizon or Sprint or whoever. Of course the truth of this observation depends on your definition of FMC, but it illuminates the roots of DiVitas’s strategy.

Second, when you start a job at a new company, they give you two things, a phone and a computer. They get both of them through the same type of channel, which is not a service provider.

Third, Skype came out of the blue from the service provider perspective; none of their founders had any voice service provider experience, but Skype is now the biggest voice service provider in the world in subscriber count.

He then launched into his presentation, pointing out that cellular penetration in the consumer space is about 75%, while in the enterprise space it’s only 20%, even though 75% of workers consider mobility “critical” or “important,” and the chances of finding a person at their desk are less than 30%.

He gave the reasons for the lack of penetration of cell phones in the enterprise as cost, control and complexity. On the cost front, he showed us his corporate phone bills – $14K for mobile and $1.4K for wireline. He acknowledged that a lot of his cellular use was lab testing, but felt that the point was still valid – cellular service is actually roughly 10x as expensive as wireline.

On the control front he pointed out that 80% of corporations use a PBX rather than Centrex, and he felt the primary reason was control issues.

On complexity, he pointed out that current solutions require multiple devices and servers – he might easily have added that they also require multiple MNO relationships for companies with international presence.

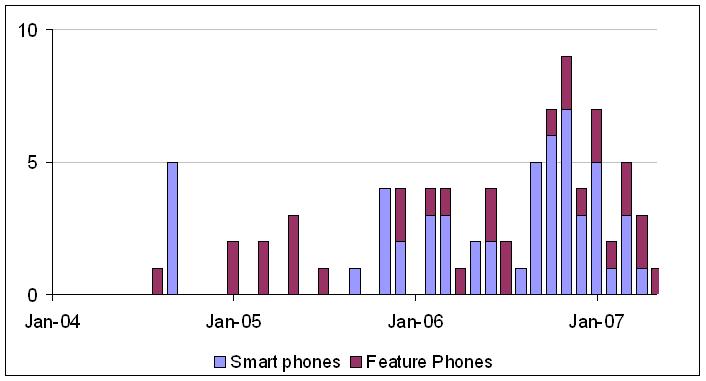

He went on to identify three major forces of change in the enterprise mobility market that are related to these barriers: first, the massive uptake of Wi-Fi, which reduces costs and increases control; second, the advent of SIP, which together with the availability of a lot of high quality open source code, lowers barriers to entry by leveraging engineering resources and increasing control. Third, the increasing potency of cell phones, with more processing power and connectivity, which he sees as reducing complexity and cost of the overall solution.

He ended up claiming an ROI for his enterprise-based FMC solution of 6 months, which may be hyperbolic, but would remain impressive even if far longer.